Every organization, cross-industry, has an accounts payable department. That’s nothing new, but the way they’re working is. Improving the performance of accounts payable functionality with digital and automated processes is slashing the time required to process payments – eliminating backlogs, preventing miscommunication with audit trails, and reducing the number of steps it takes to complete reviews, approvals, and other related tasks. Toss in a few ingredients with your ERP systems like CSP, AI, RPA, BPM, and ML and you’ll get a modern version of the way it’s been done for the past 60+ years! If you don’t know what all of those acronyms mean, you’re not alone. We’ll explain more about those in a moment.

Let’s talk history for a minute to put modernization into perspective. In the 1960s, the Accredited Standards Committee X12 established the ANSI X12 EDI (electronic data interchange) standard to help organizations transact electronic data in a consistent way. The early 1990s brought internet technology to the public and web-based, more user-friendly applications were developed to allow for electronic uploads to help facilitate the accounts payable process. Today, end-to-end robotic process automation (RPA) is streamlining accounts payable processes, improving the time it takes to pay invoices and reducing operational costs. In 2011, the U.S. Treasury estimated a savings of more than $450 million annually by adopting electronic invoicing across the federal government and mandated that all Treasury Bureaus implement their Internet Payment Platform (IPP) by the end of 2012. Some organizations saved more than 65% by implementing RPA. Fast forward to today and RPA is being used to give “breathing room” for staff to be able to focus on more customer-centric service and more valuable tasks for their companies.

Let's Talk Modernization History

1960s

Electronic Data Interchange (EDI) Standards Established

1990s

Internet-based Applications Developed

2012

U.S. Treasury Mandated Use of Internet Payment Platform (IPP) by Treasury Bureaus

2018

Businesses

Started to Adopt RPA

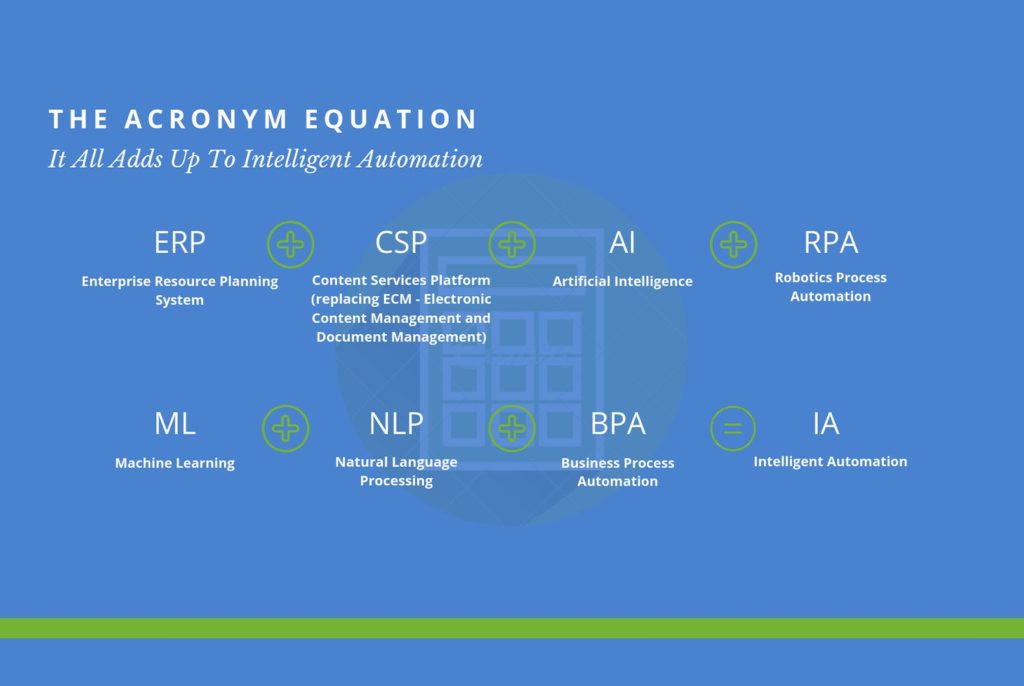

The Acronym Equation

It all adds up to intelligent automation.

- ERP = Enterprise Resource Planning System

- CSP = Content Services Platform (Gartner’s new industry standard for what was ECM – Electronic Content Management and Document Management)

- AI = Artificial Intelligence

- ML = Machine Learning (a cognitive technology that amps up RPA)

- NLP = Natural Language Processing (also a cognitive technology)

- BPA = Business Process Automation

- RPA = Robotics Process Automation

Each of these can bundle up to make up intelligent automation (IA), not to be confused with AI.