When your IT infrastructure is barely holding up, and you know it’s time for an upgrade, one of the most pressing questions you have to answer is: “But how will we pay for it?”

Traditional on-premises IT architecture requires an enormous up-front investment. Organizations hope that it will power the creation of profitable programs and reduce costs through new efficiencies. It also saddles an organization with the cost of maintaining equipment—which can be difficult to forecast. That’s why it’s not always easy to convince the higher-ups that this investment will pay off before the technology becomes outdated.

However, cloud computing offers the opportunity to pay for IT infrastructure through OpEx—in other words, to pay a more predictable amount spread out over a number of years.

OpEx vs CapEx

In the accounting world of income statements and balance sheets, purchases are classified as either capital expenditures (CapEx) or operating expenses (OpEx):

- CapEx refers to an outright purchase, the use of collateral, or taking out a loan to buy something with value that extends beyond a single tax year—an investment in the business. On the balance sheet, capital expenditures are assets that are depreciated over several years. As it is “used up,” the value of the asset declines on the balance sheet. To make a familiar comparison, buying a car would be a capital expenditure in your everyday life.

- OpEx is anything that is bought for the day-to-day running of the business. Office supplies, utilities, travel, insurance and more are considered operating expenses. OpEx are tracked as expenses on the income statement as they are paid. Leased equipment also falls into this category, as do SaaS (Software as a Service), IaaS (Infrastructure as a Service), PaaS (Platform as a Service), and AIaaS (AI as a Service). To continue our analogy, leasing a car, taking public transportation, or using a ride-share service would be an operating expense.

So, is it better to use CapEx or OpEx for transportation? If you live in a location with reliable, affordable public transportation, it might not be necessary for you to go through the upfront and ongoing maintenance costs associated with buying a car.

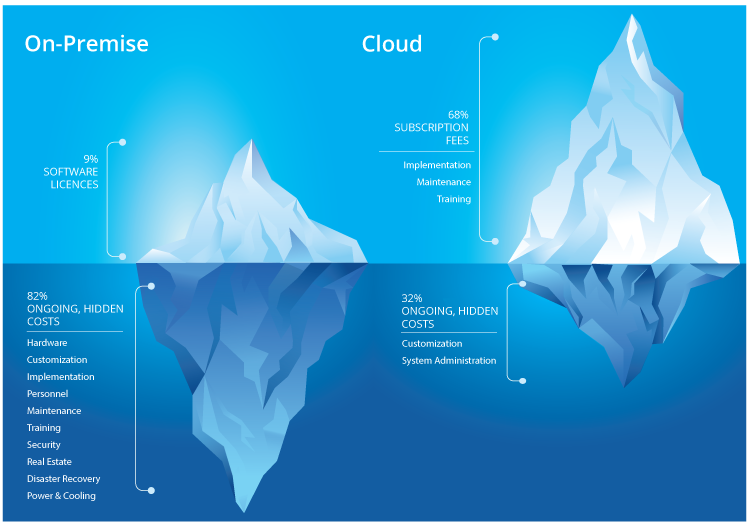

The same is true for your IT infrastructure. With the wide availability of affordable SaaS solutions, industry research shows that the total cost of ownership for an on-premises system will be more than double that of SaaS-based cloud solutions.

CapEx—The Traditional Way to Pay for IT

Traditionally, big IT buys are budgeted as CapEx, one-time purchases that are expected to generate benefits over multiple years in the future—but are paid for now. These upfront costs include IT-related facilities, computer and networking hardware, software licenses, HVAC (cooling) equipment, backup generators, maintenance, and insurance. Intangible assets like the cost of trademarks, patents, and copyrights also fall into the category of CapEx.

Using CapEx for IT has several drawbacks. CapEx purchases often are complicated by multiple dependencies and usually require approval from multiple leaders with differing perspectives, which can create slowdowns and roadblocks. The costs can be depreciated over 5-10 years. There is always a risk that today’s expensive tech upgrade becomes obsolete—or prevents you from moving quickly to a new and better solution—before it can be written off. Plus, you might be forced to overbuy based on cyclical needs or peak demand that only happens a few times a year. With CapEx, your IT forecasting must be precise.

On the other hand, CapEx purchases have tax benefits and create predictable monthly costs as payment schedules are structured prior to purchase. If you own your technology outright, you are in total control—but also assume full responsibility for maintenance, backups, etc.

Cloud-Based IT and the Shift to OpEx

According to a recent Gartner report, at least 75 percent of organizations have prioritized the implementation of cloud-based solutions using managed service providers like us. The value proposition is compelling for the following reasons:

- Provides a subscription-based service

- Scales quickly to meet demand

- Meets requirements of your organization by tailoring your solution

- Allows for shorter durations for completing projects

- Speeds up the time to market

- Increases profitability

- Makes it easier to track ROI

- Bundles into a predictable, monthly payment

- Frees up cash to evolve with new tools and services

- Reduces upfront spending for on-prem and installed technology

- Solidifies concrete subscription pricing – making it easier to budget for the year

- Expedites the purchasing process

- Eliminates upfront costs for hardware implementations

- Lessens the need for hardware and software upgrades by making it accessible from anywhere

- Includes 24/7 service and maintenance

- Frees your staff for higher-level projects

Things to Keep In Mind

While it seems like the choice of divesting ownership of IT assets to purchasing cloud-based technologies as OpEx is a slam dunk, there are some important things to consider:

- Cloud buys as OpEx hand over control to a third party. You need to be certain your technology partner is stable, reliable, and can quickly respond to your needs. They need to be experts in the technologies they implement and provide top-notch support.

- There are always risks involved in migrating from one infrastructure to another. To minimize or avoid downtime, be sure your provider can also deliver tailored documentation and training for your staff.

- When purchasing software licenses, there may be penalties associated with cancellation, or you might be stuck with the full cost—even if you are no longer using the software. Review and negotiate subscription terms.

In general, there will always be budget pressure to minimize operating expenses. Cloud-based IT services are an OpEx cost, but those expenses are mitigated by the ability to reallocate staff, change staffing levels, and lower CapEx, making more cash available for other projects.

Ready to explore OpEx benefits for your organization? Learn more about our Managed Cloud offering.